For accrual basis taxpayers, income is recognized when 1) all events test has been met and 2) amounts are fixed and determinable w/reasonable accuracy. We know from Sec 451 that income is generally required to be recognized in year payment is “received”, unless exception applies. The deferred revenue we will be dealing with is one of the exceptions.

We do have choices. We could choose Full Inclusion of deferred revenues (net of anticipated COGS) in the tax return. I mean, if we’re crazy and want to pay the tax now, that is. Most companies won’t choose this though, so no time wasted talking unicorns and rainbows. Deferral Method it is.

Deferred revenue can be some complicated stuff. Just to be clear, we are only dealing with transactions to which section 451(c)(1)(B)(iii) applies. This section essentially says that receipts related to deferred revenue on a set of AFS may also be deferred receipts for tax but: 1) only one year max deferral for tax, and 2) relating to transactions that will be recognized in tax year 2 for GAAP (either partially or in full). This applies to both goods and services, so your transactions are likely covered. So if you have long term construction contracts or the like, this section is not for you.

If there is no AFS, go see reg 1.451-8(d), but basically same treatment.

As in all things tax, nothing is clear. “Received” does not mean only payments received in the bank account. We are also talking amounts billed/invoiced, or even amounts not yet invoiced (think constructive receipt) Sec 451(b)(1)(A)(i). So if the contract states that $100k is to be due every 12/31/CY and the client hasn’t gotten around to billing (or perhaps for tax purposes thinks they can skip the billing until 01/01/NY), the IRS would include that under audit. And therefore so should the client (unless they have a sadistic burning desire to fill out a UTP form with their next tax return).

Just like in Full Inclusion, the Deferral Method also gets to include a reduction for COGS (Reg 1.451-8(e)(1) – (4). This is already going to be included in the GAAP financial statements when the deferred revenue is calculated. Usually we just assume the GAAP COGS for deferred revenue is materially close to what would be calculated for tax. But it might not be. So keep that in mind as you may need an additional temporary item adjustment for this. If you use this assumption, document it in your workpaper. (Review points suck, just minimize them where possible.)

The tax Deferred Revenue temporary item is driven by the “receipt” date and amount. It is not driven by the contract date. For instance, a $100k contract paid up front for which that contract has deliverables over 5 years is going get a deferral to year 2, max. The same contract invoiced at $20k a year is going to have separate calculations of what is deferred every year. It matters not whether I have it all residing under one contract, or carve it into 5 separate one year contracts (assuming it is all for the same good/service type). It does not mean that for years 2-5 no deferral is allowed. The change in our billing is the driver this whole calculation. So buckle up and let’s dive into it.

Items Needed

- Deferred Revenue detail which ties to the GAAP trial balance amounts that includes the amount of Job to Date (JTD – from inception of job/contract through to year end) billings/invoiced amount.

- The same exact report for the prior year.

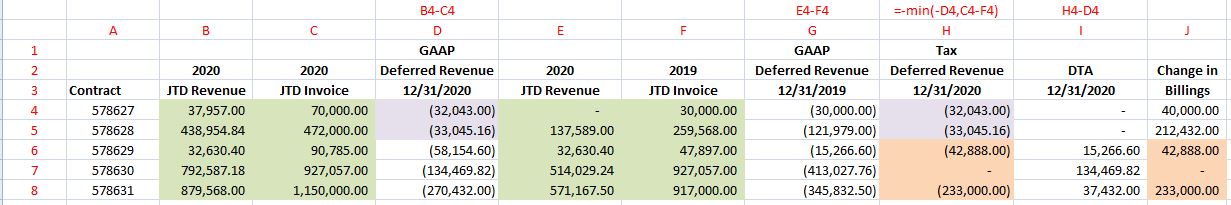

The information in columns A thru G is provided by the client (or from the assurance department’s workpapers on Deferred Revenue). You will be adding in the calculations for columns H and I (with the formulas noted above).

Column J is not needed, but it helps you to understand what is happening. When the change in billing is less than the GAAP Deferred Revenue, this means that what is deferred for tax cannot be less than what JTD is actual recognized as earned for GAAP. Note the purple items in Tax Deferred Revenue matches the GAAP Deferred Revenue. You have no DTA/DTL, no difference book to tax.

When the increase in the billings exceeds the GAAP Deferred Revenue, this is the amount that we can deferred (this billed but not earned) for one year. This then becomes our Tax Deferred Revenue. The Deferred Tax Asset will be the difference between GAAP and Tax Deferred Revenue. Take the difference between the CY DTA and the PY DTA and that is your CY Current Provision amount. Then make sure that your ending DTA per your CY Deferred Provision matches these supporting calculations. If it does, good. Your number is audit-able and has fully detailed support to back it up. If it does not match, you likely are off in your beginning DTA and need some clean up accounting.