Question 1 – Can they take it with them when they go?

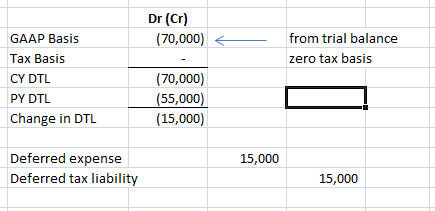

For accrued vacation to be currently deductible for tax purposes, the compensation must be nonforfeitable. If the employee is allowed to walk out and quit (with or without notice) in January and still receive their accrued vacation, then the pay is nonforfeitable compensation. We get this guidance from §404(a)(5), see Tax Compensation 101. So go ask your client. If the answer is no, then your result will look similar to below:

Question 2 – What is the amount utilized within 2.5 months of year end?

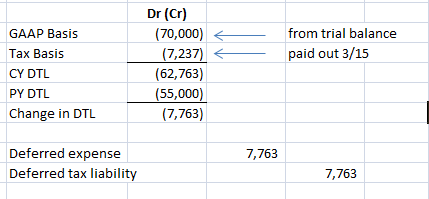

If the answer is yes, then we have a 2 part math problem. We need to know 1) the amount of the accrued vacation as of year-end that was 2) paid out as compensation within the 15 day of the 3rd month after year end (3/15/x2 if the taxable year end was 12/31/x1).

Ask the client for this information and they will typically either give you the accrued vacation at 12/31, or the accrued vacation as of 3/15 of the next year.

Do yourself a favor, and just ask for the client for vacation utilized as compensation 1/1 through 3/15. The odds of any of this vacation utilized being attributed to earned vacation during the same period is slim. We’re not looking for absolute precision with a listing of each employee’s accrual, accrued vacation is likely not a material piece of the provision. Write something to the effect of “Vacation compensation paid out from 1/1 through 3/15 is assumed to be attributed to the 12/31 accrual. Any amount earned and paid during the year to date period ending 3/15/x2 is deemed immaterial to calculation.”

Thinking about tax basis can be confusing, so consider this: if I was to go back and create a set of books on tax basis, I would assume my current year vacation accrual at 12/31 year end could only be comprised of what was actually deductible for 12/31. This is only the portion paid within 2.5 months of 12/31. The rest, for tax purposes, hasn’t yet occurred. That is because even though we may be an accrual basis tax payer, when it comes to accrued vacation 404(a)(5) puts us on the cash basis for all except the 2.5 month payment.