Buckle up, GAAPers

Welcome to the weird world of tax deductions! My dear wish for you, reader, is that you are a tax professional and this will be mere review. Maybe you’ll pick up a few things. If, however, you come from the GAAP universe then you may want to grab a box of tissues before beginning.

GAAP was designed on a foundation of reasonable rules, one of which is expenses should be recorded in the period that matches the income they help generate.

Tax laws are drafted by feral humans who eschew reasonability. It is biased in every direction, penalizing one group while carving out loopholes for another.

Three Elements for a Tax Deduction

- All events have occurred to actually establish the liability (aka, Fixed or also know as the All Events Test).

- Said liability can be determined with reasonable accuracy (aka, Determinable).

- Economic performance has occurred

Something to keep in mind is that the elements for recording income for tax purpose is limited to the first two above elements only (what we typically call “Fixed and Determinable”). So economic performance is a deduction only concept.

Economic Performance

Economic performance (EP) occurs as a taxpayer either:

- receives property or services,

- is allowed to use property,

- provides property or service

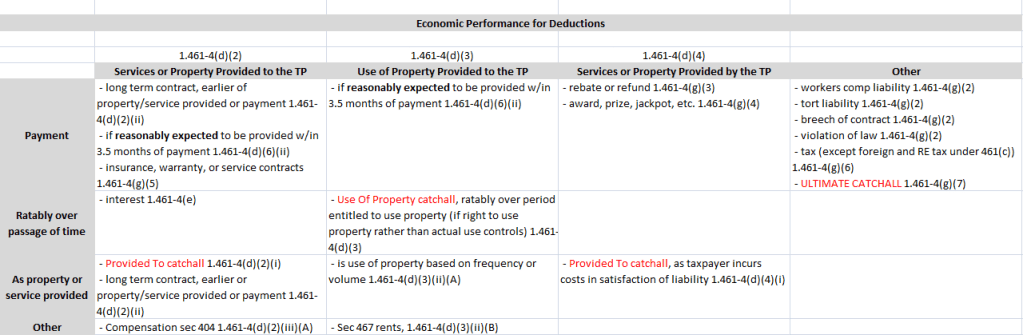

Each of these categories has a catchall provision, and multiple exceptions. These catchalls serve to provide guidance for what to do if a transactions lands within a general category, but does not have any exception or specific guidance. If in the rare circumstance it is difficult to say what general category a transaction fall into, there is a ultimate catchall which applies.

I created the above matrix to help me wrap my mind around EP back when I worked in private and have carried it forward in my career. This screenshot lives in many of my workpapers at various firms. It is by no means complete.

To show how EP can be tricky, let’s use a real example. Our company leases a corporate jet for executive use for one year (6/1/2021 – 5/30/2022). This is use of property, so we start in Use of Property Provided to the Taxpayer column and see that we likely take the deduction ratably over the period we are entitled to use the property. But wait. In our lease, it limits use to 10,000 miles (maybe it allows us to carryover unused miles to the next lease year, maybe not). So now it looks like we fall into based on frequency or volume and may need to take our deductions as the property/service is used.

What if the company signed the one year lease because an executive retreat was planned in late July for which the company intents to use all 10,000 miles? And the lease required upfront payment (prepaid) either partially or in full? Under these 3 slightly different scenarios, EP has moved from ratably over time, to as property provided, to when payment is made.

Recurring Item Exception

A deduction is allowed if:

- All Events test is met

- EP occurs before the earlier of the filing of the returns (or extended return) or 8.5 months after year end (this is generally 9/15 which is the extended due date for return originally due 3/15, C Corps generally have 4/15 due date).

- Nature of item is recurring

- The item is not material, or accruing deduction makes a more proper match than EP.

Wait…Did I see Two Exceptions

Yes. You did. If the taxpayer reasonably expects to use property/service within 3.5 months of payment, then a deduction can be taken in the year paid.

What do we mean by reasonably expects? So, you don’t have to ACTUALLY use it? That’s correct. Take this scenario: It’s February 2020. Your company has a trade show in April 2020 that you are not so excited to attend. You book your booth (Use of Property Provided to TP) and pay the $6k upfront. Come April, you are marooned at home with your two children, desperately trying to pull off remote Q1 reporting while educating your children at the same time and thinking that trade show trip sounds like a dream vacation. Will that booth be a deduction in 2020, despite the fact that they have given your company a credit for 2021 trade show space? You bet your booty it is!