What is a TARF

Think of the TARF as the table of contents to your provision. This reconciliation serves to break down the changes in all of the income tax related accounts (taxes payable/receivable, DTA/DTL, Valuation Allowance, and tax expenses), proving every element in your provision has a reason for being there.

When I worked preparing provisions in-house for an NYSE traded insurance company, preparing TARFs was a snap. Having massive internal controls, no one would dare book anything to any of my tax accounts. I simply started with prior period balances, added in all payments and receipts and accruals and BOOM, done in minutes. This is NOT the case working in public accounting where clients either book excessively to the tax accounts, or book next to nothing at all, requiring a lot of patience and investigative accounting skills to pull off a TARF without pulling our your hair.

Preliminary Steps

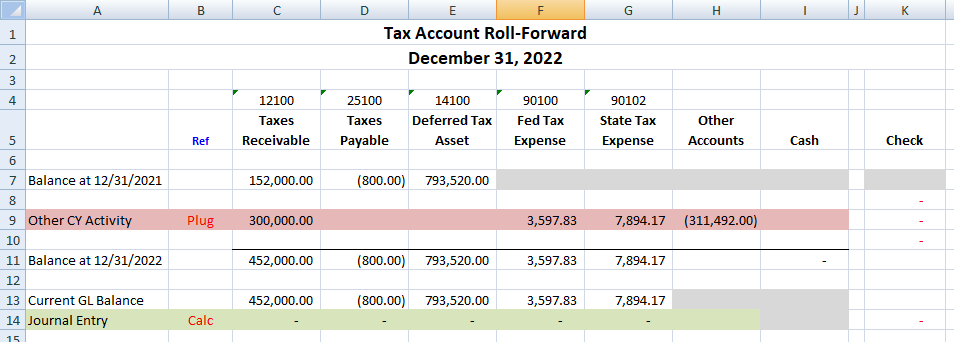

- Start with PY general ledger balances (row 7 below). If you are lucky, these will match the figures used in the PY issued financial statements. Sadly, clients do not always book the entries given to them by their CPA. If that is not that case, insert rows for these adjustments but DO NOT POPULATE YET.

- Put in the ending general ledger balances for the current year as a check figure (row 13).

- Create plug rows for a generic “Other Current Year Activity” row (yes, I know it sounds bizarre, we’ll fix this I promise). To balance this row, plug up your “Other Accounts” column (row 9). The Other Accounts column is required because sometimes we have feral accountants booking non-income tax items to our tax accounts.

- Set up your provision journal entry and note that it currently balances across all accounts to net to zero (row 14). Now your task is to complete the rest of the TARF while never letting the entry get back out of balance.

Intermediate Steps

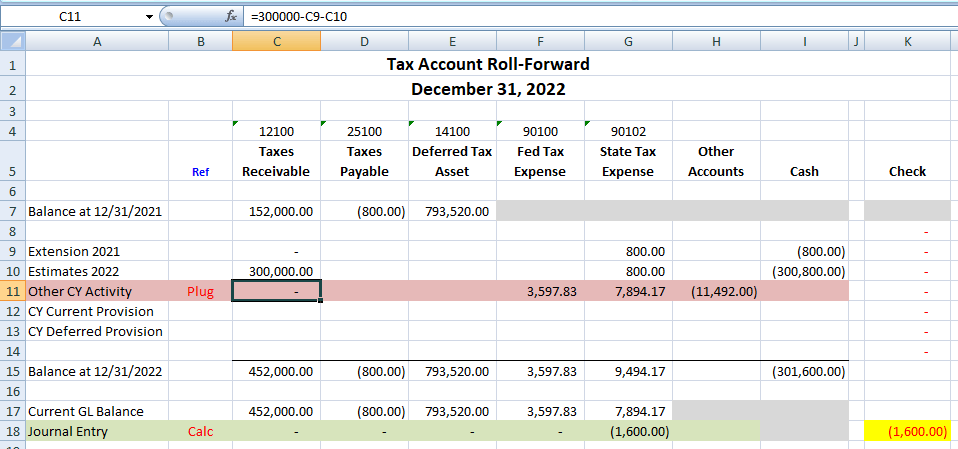

5. From here, you now going to pull as many transactions as you can out of the red highlighted plugs based on a mix of the GL activity and what you know from the tax return. In this example, $300k was paid for federal tax estimates for the CY. Note that the other side of the entry must have been cash paid. In the top bar, you can see that I am pulling rows 9 and 10 out of my plug figure for row 11.

Similar payments were also made for CA 2021 extension and for 2022 estimates, however, the entry was booked to the tax expense account rather than the taxes payable/receivable accounts by the client. You can see in these screen shot a check figure in yellow highlight. This is because I have not taken rows 9 and 10 out of my plug figure in cell G11. Once I do this, the journal entry will once again be in balance.

If you don’t want review points, or to have to freak out later trying to remember where figures came from, add references to B9 and B10.

Note the use of the Cash Column. Without fail, someone is going to ask you for cash paid for taxes for that pesky Cash Flow Statement disclosure. Just point them to the TARF. And don’t try to include the cash column in your journal entry. It really undermines your credibility as a provision accountant to try and hit cash, though that doesn’t stop me from attempting it on occasion.

6. Once you have pulled as many transactions out of the plug as you can, you can look at the remaining balance and figure out what to do. Here, the GL detail for accounts 90100 and 90102 tax expenses was reviewed and it was found the client had booked property and sales tax, and of course use the tax expense account as a plug to clean up another account. Another row is inserted to remove these accounts and via the other accounts column. Add a cell comment, or reference to how these figures were verified and to which accounts they should have been booked to, or simply book to an “other” or “miscellaneous” income statement account. Note that we have to pick up this adjustment in our journal entry (orange highlight, cells H13 and H21). Phew, that JE is back in balance!

WARNING – If you have just hit an expense account other than an income tax account, you have just changed your pre-tax GAAP income, and thus your taxable income and your tax expense. You MUST add this adjustment into pre-tax GAAP income on your Current Provision calc, right now! For this reason, if the amount is immaterial is may be best to leave these amounts in as a RTP Current. Pass and move one.

7. Now we can add in the CY Current Provision and Deferred Provision figures.

8. Lastly, you will want to check that row 18 checks back to other support. C18 and C19 should tie back to a schedule of what makes up the balance (PY refunds not yet received detailed by year, balances due or overpayments on the current provision’s tax return). E18 should tie back to the Deferred Provision. And F18 and G18 should tie back to 1) Current Provision, 2) Deferred Provision, and 3) your RTP calculations. I did not include Return to Provision figures in this basic TARF, but they function identical to the CY Provision in the TARF.

Remember, if you can’t tie out your balances to objectively verifiable support, your work is not auditable. If it’s not auditable, it’s either not done.