A rate reconciliation takes the pre-tax income from continuing operations and multiplies it by the statutory federal rate of the parent in order to create an expected tax expense for the year’s activity.

Then it shows adjustments to get down to the actual tax expense for the year’s activity.

Keep in mind, the ultimate tax expense that it both starts and ends with is not what one would expect on the tax return for the current year. It is taxed over the current and future tax years. For instance, if you place a depreciable asset like equipment in service during the year, that will generate tax deductions on the current year tax return, and future tax returns (ignore any bonus/sec 179 deductions in this example). It doesn’t matter that the GAAP deduction and the tax deduction for any given year doesn’t match. Over several years, it will be the exact same deduction, the cost of the equipment. Over all years is the period the tax expense is measuring. Not just current. Not just deferred. Total tax expense.

That is to say, temporary items (items that are Deferred Tax Assets/Deferred Tax Liabilities) are not included in this calculation. This is key to understanding the rate rec. We are dealing with total tax expense, the combination of current and deferred tax expense. If any item would appear as a Deferred Tax Asset/Liability, it is already included in the pre-tax GAAP income from continuing operations. For example, the 1/5 straightline GAAP depreciation expense on that piece of equipment is already included in the pre-tax GAAP income x 21% tax rate that kicks off the rate rec. You don’t need to make any adjustment, as over time GAAP = tax deduction on that piece of equipment.

Rate recs are notorious for being the hardest part of a tax provision because conceptually it makes sense at the big picture level, but it is so easy to get lost in the details if you forget the above aspect that temp items don’t matter.

I do my rate recs in two steps:

- Do all return to provision account reconciliations when provision is initially rolled forward to the current year. At this point, I draft my rate rec using only RTP/cleanup items. It balances out total tax expense to the TARF pretty darn easy.

- After the full provision is done,

- Matrix out your jurisdictions into an expense proof

- go down the current provision (aka taxable income calc) and use one color for perms, and another for temps. As you deal with each item, color it.

- Each perm item should appear on your expense proof

- Each temp item should appear on your deferred provision (DTA/DTL schedule). Use the same color and color each item that matches the current provision on the deferred provision.

- Any items on the current provision (aka taxable income calc) that are not colored at this point need to be addressed as perm or temp.

- Any items on the deferred provision that are not colored need to be addressed

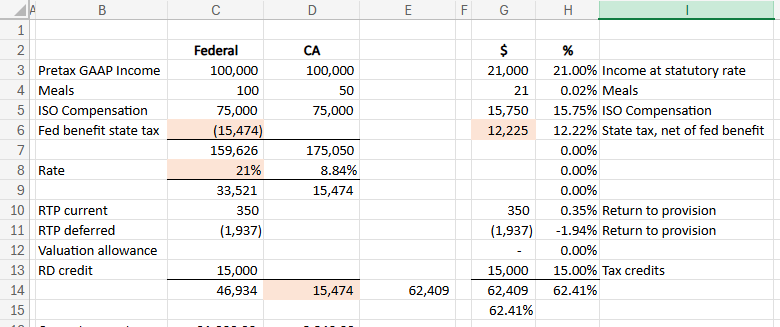

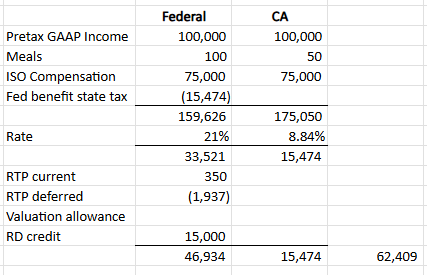

3. Once you have created the expense proof and it ties back to your actual total tax expense, throw your rate rec in on the side. Column G is Column C*.21 for rows 3-6 (plus state tax expense at D14, see orange cells), and for post tax items just column C for rows 10-13. Column H is Column G/$C$3.