I have typically only seen true interim provision for publicly traded clients, or for those going through an IPO/SPAC. If Interim Provisions apply to you, you are going to want to get really comfortable with process. For a newbie, a regular provision is hard enough to master, so I would recommend go back as much as possible to fill in any learning gaps (GAAPs) on provisions that you come across as you draft or review the Interim Provision.

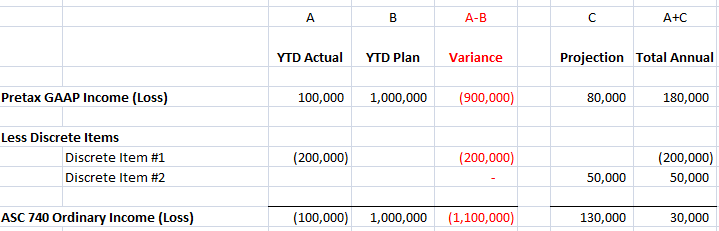

Step 1. Determine ASC 740 Ordinary Income

ASC 740 Ordinary Income is not the same as ordinary income defined for purposes of preparing a tax return, so take the concept of ordinary vs capital income and toss it. It is not uncommon for folks well versed in tax and light on GAAP to try and mess with this very important starting point of the Interim Provision. I’m looking at you, reviewers with MSTs with almost zero experience with GAAP. And my Big4 2nd year assurance staff (the know-it-all teenagers of the accounting world). Calm yourself.

Ordinary Income is simply GAAP net income + or – tax expense (benefit) + or – Discrete Items.

Discrete Items are transactions that the Provision Gods have deemed to skew the overall projected tax expense if included in the estimated Annual Effective Tax Rate (AETR). I think of these in 3 buckets:

- Non-Qualified Stock Based Compensation windfall/shortfall on exercises (tax only Discrete Item).

- Significant Unusual or Infrequent items (the GAAP ones that get disclosed, or tax ones that you will be disclosing in your tax footnote. If you aren’t disclosing, its not that material, pass.)

- Other stuff that requires me to look up/learn and then quickly forget

Public, or soon-to-be-public companies typically have a formal budget or plan for the fiscal year. This plan (Plan), and changes to said Plan, will be frequently discussed in Board of Directors minutes. So grab the Plan, the Minutes, and your collective knowledge of company operations.

First look at the variance between Plan to Actual. If there is a budget department then ask them to give you explanations and support for material differences.

Next look at what the Plan projects for the remaining future quarters. Make any adjustments necessary per information in the BOD Minutes, explanation on variances, and other knowledge of the company into the amounts for column C. You can make this real fancy, I had one in private that was 13 columns of bull pooey to get to Total Annual. If you document in full glory, the auditors generally leave you alone.

Adjust out any Discrete Items already recorded in pre-tax GAAP income, say something related to business combinations, or a big messy impairment. My imagination is running low. You get the picture.

You need to do this same determination for each material jurisdiction’s ASC 740 Ordinary Income. For simplicity, only federal is shown below.

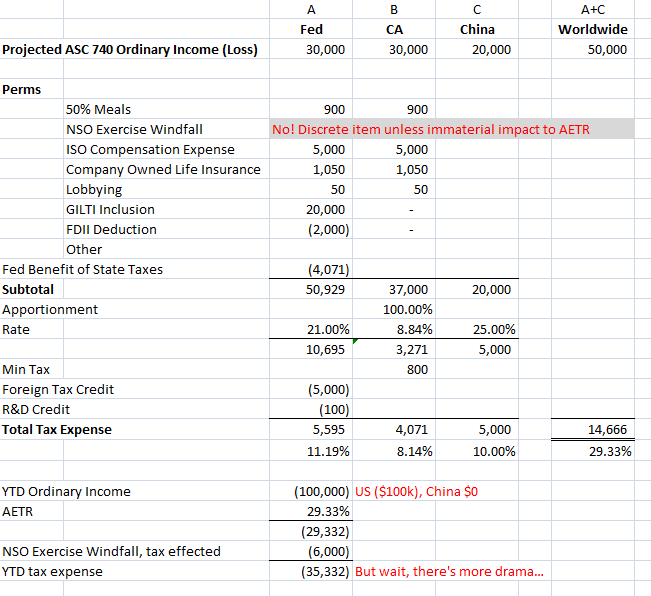

2. Calculate Projected Taxable Income

This is where you ask, do I need to calculate a full provision (current and deferred)? Chances are good that you don’t. Disclosures at interim are generally confined to “material changes” in items since year end. This means that you may not even be required to disclosed your deferred tax assets/liabilities. Can you prove that changes to your deferreds would be immaterial to the financials? Or are you trying to use as much time as possible on each quarter cycle to show your VP of Accounting that no, you absolutely don’t have time to take on Unclaimed Property reporting across 35 states (which your consolidated company comprising of 11 subsidiaries would generate approximately 385 separate state filings)? OMG girl, then calc a full provision with high drama every time. Self preservation!

This comes as a surprise to those in public accounting, but in a large accounting departments the provision process generally starts with computing total tax expense. This is done so that accounting can close the Income Statement, and then work on the Balance Sheet only items. Time is of the essence, and the execs typically want earnings figures ASAP. In some industries, additional accounting, such as pooling, must be done before final Balance Sheet figures are produced. And a provision cannot be done with out final Pretax GAAP Trial Balance. So do what us pros do, total tax expense first.

Finding total tax expense is the same process as producing the effective tax rate. We don’t care about temporary items.

Pretend that both California and China jurisdictions are material to the tax provision. If additional jurisdictions are immaterial, do yourself a favor and document the reasons why and pass. Same thing goes for the permanent and other items shown below. In reality, only the Ordinary Income, GILTI, and Foreign Tax Credits would likely be material in the below example. CA could probably be left off entirely.

If your permanent adjustments figures come from Plan, you may likely need to continue the same analysis of Actual to Plan from above for each jurisdiction as well. (When I worked insurance, we had some HEAVY projections coming from Plan for investments that required extensive Plan to Actual, as well as some crazy 162(m)/PSU/RSU/Option scenarios that were head scratchers/day drinking inducing nightmares.) But we’ll keep it simple. Below we combined all our by-jurisdiction projections of taxable income. Assume that YTD Ordinary Income is the ($100,000) and that China subsidiary YTD is $0.

Note our little tax Discrete Item there at the bottom of $6k, I probably should have labeled that better.

3. Is it NMLTN

ASC 740 limits the recognition of deferred tax assets to the extent that they are more likely than not to be utilized. Let’s say that this YTD Ordinary Loss of $100k is expect to yield both some usable DTAs and also an increase to a NOL DTA. If it is not more likely than not (NMLTN) that the NOL creation that is being projected within the YTD tax benefit that we are about to record, then we cannot record the portion of the $35k benefit for which we are going to slap a valuation allowance on. We may only record tax benefits on loss we can use in the current year, or that we MLTN will use in future years.

4. Evaluation if Full Provision Needed

Once the total tax expense has been calculated, you can get a feel for whether a full provision calc is even necessary. In my experience generally all temporary items have immaterial changes, or just one or two have material changes. In this case, calculate the deferred provision for these few items separately and record as deferred expense (benefit)/deferred tax asset (liability). The remaining amount will be current expense (benefit)/taxes receivable (payable). So yes, technically we need to always calculate the interim provision in regards to current and deferred tax expense. But how detailed that process is depends on circumstances.