Deferred Tax Assets and Liabilities

If a Deferred Provision was a Lego house, the DTA/DTLs would be the Lego bricks. That is to say, a Deferred Provision is comprised of not much else.

A deferred tax asset or liability is the difference between the Tax and the GAAP basis of an item at a given point in time. This difference occurs either 1) over time as tax returns are filed (such as GAAP vs tax differences in depreciation of fixed assets), or 2) it occurs because a transaction is recognized for one set of books and not the other (like non qualified stock based compensation recorded for GAAP, where Tax is like…”until someone exercises, I see no point in recognizing anything, get outta my yard ya hooligan.”)

Where does one find these GAAP and Tax basis? Don’t let the fancy terms scare you. Finding basis is actually pretty simple.

GAAP basis is found generally on the Balance Sheets. Even simpler, start with the balance sheet accounts on the Trial Balance.

How do you find the tax basis…well, that’s a little bit more involved (not harder, not scarier, just more steps). It may be directly in the tax return (like the depreciation schedule that supports Form 4562). It may be equal to GAAP (think AP, AR, cash, etc). It might even be zero. Or it could take some work to get there (like prepaids, deferred revenue, and many, many others). If you don’t know how to get to tax basis, search the Tax Sophomore site by the corresponding GAAP category (asset, liability, or equity) for the item in question, look at PY workpapers, or do some basic tax research.

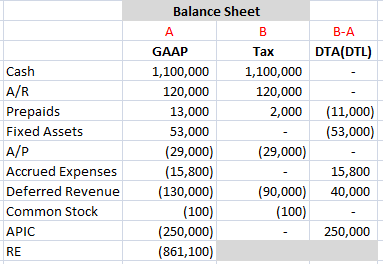

Let’s say you’ve found the difference in your two basis, how do you tell whether you are looking at a DTA or a DTL? After years of looking at ridiculous matrixes designed for people way smarter than me, I gave up and found a much dumber solution that was just there all along. Simply leave your accounts in debit and credit form (as shown on a TB) and simply take Tax – GAAP. (Balance Sheet = Basis)

Prior Year Column

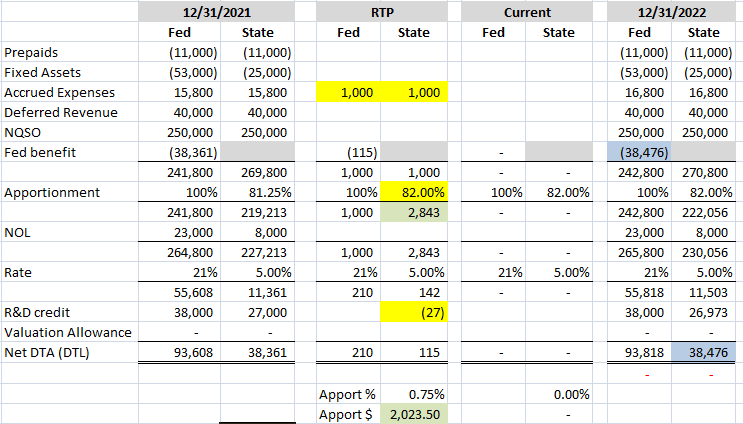

My preferred deferred provision is comprise of 4 sets of figures: 1) deferred tax assets and liabilities balances from the prior year, 2) clean up of the inevitable boo-boos and genuine return to provision (RTP) adjustments, 3) the current year provision activity, and 4) the total ending deferred tax assets and liabilities.

The Prior Year column should come directly from the prior year provision’s ending DTAs/DTLs. If a provision didn’t exist before, then you are going to find the GAAP and Tax basis for each item and create this column. This won’t be completely from scratch. Grab last year’s Trial Balance and either the M-1 (or the M-3) from prior year’s tax return and you can easily recreate the balances.

RTP and Cleanup Column

The next column is likely going to be a return to provision and/or general cleanup. If it’s my first year on a provision, dollars to donuts I’m going to be cleaning up A LOT of figures using 1) tax return and 2) check figures (see section on Ending DTA/DTL Balances). If the boo-boos are more than just what was make in the prior year tax return (like prior year’s prior-year balances were off, too) I will make separate RTP and Cleanup columns just for my sanity.

Start with the following items and check that Prior Year column matches the tax return:

- Net operating loss carryforward

- Credit carryforward (foreign tax, research, and other general business credits)

- Apportionment percentages and tax rates used on states

For instance, in the below setup the State RD credit carryforward was estimated to be $27,000, but on the 2021 return it was actually 26,973, a difference of $27. The RTP column essentially acts as a plug to get the ending figure where it needs to be. (If there is a lot of RTP activity, throw an adjusted 12/31/2021 column in between your RTP and Current columns, right now the 12/31/2022 column is showing us adjusted because there is no current year activity yet).

Two other changes occurred. Accrued expense per the provision was $1,000 off, and our estimated state apportionment of 81.25% was off of the actual 82% by .75. To get the change, take the 269,800 (PY pretax effected state DTAs)and multiply by .75% (2,023.50 shown in green). Then add this to the RTP calculation for tax effected state DTAs (also in green). It doesn’t have to be complex.

Note the figures in blue. State income taxes are allowed as a deduction for fed, but generally we take them after they are actually paid. If state taxes are taken at 79% of the 38,476, this is the same effect but shown on state rather than the federal side. And guess what. This is considered netting across jurisdictions and not allowed by ASC 740. If its immaterial, who cares?! Well, I’m a rule follower. If Egon Spengler says crossing the streams can bring about complete protonic reversals, surely booking across jurisdictions could also affect life as we know it.

Current Column

Now that the Deferred Provision has been cleaned up for prior year tax return, the Current column can be populated. This pulls directly from the Current Provision for all the temporary items. Note below that the state apportionment for the current year is different than the prior year tax return (green). This is based a current year estimate, and the same adjustment occurs to step the apportionment percentage up as before.

Current Period Ending Column

The Current Period Ending column (12/31/2022) is self populating, as it adds across the other columns by jurisdiction. All that is left is to check each ending balance back to support (the referencing shown in red to the right).

You might be tempted to think: Why would I need to check each ending balance back to the workpapers? I know what the beginning balance was (came from prior year, which I tied back to the tax return). The current I know is correct from the Current Provision, which is essentially a tax return. And I am a tax preparer who knows my stuff.

Don’t forget, my dear provision preparer, that this will be audited. You may even be the lucky tax accountant assigned by the CPA firm you work for prepare AND AUDIT the provision. And what auditors do is tie back ending balance sheet amounts to support. And what tax preparers are not focused on is anything other than the current year’s tax return. And this, my friend, makes material misstatements. Not this year, oh no. But over time; maybe in 2 years, maybe 5 years. But rest assured if YOU are not checking ending balances to support, no one on your audit team is. You will find that a few prior periods earlier someone didn’t quite know provisions well, and those effects have been accumulating.

Don’t believe me? Start by checking the fixed asset ending DTA/DTL and you will likely find an error. Make the adjustment back through the RTP column (so the ending balance is accurate and you have not touched your current year provision/tax return calculation). Likely this adjustment is immaterial. If its material, change your pants, continue checking all other DTA/DTLs, hope it nets out, and discuss with your higher ups.

Wrap up

Now time to move to the Rate Rec and the Tax Account Rollforward. You’ll want to take a few items with you from the Deferred Provision.

Rate Rec

- Change in Valuation Allowance

- Change in Apportionment

- Return to Provision/PY Cleanup

- Tax Credits GENERATED

Tax Account Rollforward

- CY Deferred Tax Expense (fed and state)

- RTP – Deferred Tax Expense (fed and state)